how much taxes are taken out of paycheck in michigan

Every other state that collects income taxes has tax brackets based on income similar to the federal government. You sent me money according to marvin Tuesday Its now Thursday and it still isnt in there.

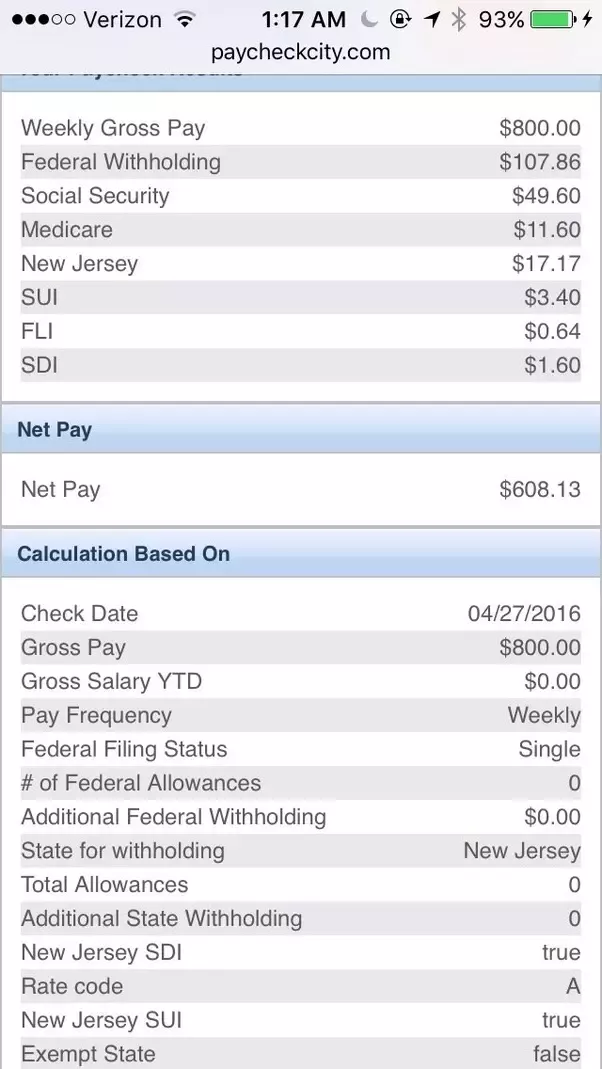

I Make 800 A Week How Much Will That Be After Taxes Quora

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

. However if you dont file within 60 days of the April due date the minimum penalty is 210 or 100 of your unpaid tax whichever is less. 2674 Amount taken out of an average biweekly paycheck. The Payroll Tax also known as the FICA tax refers to the two mandatory taxes paid by all employees which contribute to the Social Security and Medicare programs.

These creditors have a statutory right to take money directly out of your paycheck. Although Iowas state income tax rates start out low at just 036 percent they rapidly jump up to 792 percent for both single and joint filers earning 50000 one of the higher rates in the country. There are many types of student loans so its also important to figure out.

If you havent yet taken out student loans its worth thinking really hard about whether or not theyre worth it. Wage garnishment happens when a court orders that your employer withhold a specific portion of your paycheck and send it directly to the creditor or. For FICA taxes this is typically done quarterly but in some instances where the total tax liability is small it may be done annually.

A 100000 Michigan salary is trimmed to 72018 by federal and state taxes including an estimated 408 state income tax bite. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. In addition to withholding based on the allowances you claim you can choose to have more taxes taken out of your paycheck either as a percentage of your pay or a flat dollar amount.

If youve already taken out student loans and the interest rate if above 5 then you should consider student loan refinancing and other ways for you to reduce student loan debt. However calculating state taxes is not as challenging or expensive as there are usually far fewer brackets to work with and the rates are a lot lower. How much does a co-signer help when taking out an auto loan.

There are extenuating circumstances under which the IRS will waive late filing penalties. Amount taken out of a bi-weekly paycheck. Therefore if you owed 210 in taxes and you waited 60 days to file you wind up paying 420 total.

All data was collected on and up top. But how far they can help depends on your financial health. It lists in detail your gross earnings also known as revenue net pay also known as take-home income or what you get to keep as well as deductions associated.

Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return. The type of pay you are receiving. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87.

You guys have me locked out of my account. Amount taken out of a bi-weekly paycheck. Total income taxes paid.

A paycheck stub is usually included with or attached to your check. State payroll tax deposit and filing procedures vary by state. Total income taxes paid.

Total income taxes paid. There are also other trust funds like the Highway Trust Fund which comes from gasoline taxes. I cant get through to your number and like you said I cant go in with out a appointment which I have to call the 0017 number to do.

Back to Top Hours and Earnings. The amount youve chosen will be shown on the Addl. FUTA taxes are reported annually.

Your employer also must pay taxes for you for Social Security and Medicare. I cant enail you bc you have me locked out no it dosent unlock after 30 mins. Payroll taxes that both employers and employees pay.

Iowa residents take home an almost identical after-tax paycheck as their Midwestern kin in Indiana. A paystub earnings statement check stub payslip or paycheck stub. These include the 62 for Social Security taxes and the 145 for Medicare taxes that your employer withholds from your earnings each pay period.

Businesses must also report how much federal payroll tax they withheld and paid throughout the year. Your employer also matches those contributions so that the total contributions are double what you. Iowans that can increase their income.

If you are dressing and feeding. Box 2 which is right under Box 1 lists the number of qualifying children that were taken into account when the advance payments were determined for 2021. It can also be used to help fill steps 3 and 4 of a W-4 form.

But creditors cant seize all of the money in your paycheck. Payroll taxes are taken out of your paycheck before you get it and might appear on your paystub as FICA SS SOCSEC or other names for Social Security. Register with your employees state tax agency.

As a result many taxpayers are unaware of. Different rules and legal limits determine how. How State and Federal Withholding Tax Works.

Any calculation does not take into account the costs or fees associated with 1 transferring assets between the accounts 2 the differences in the rate of return on investments within the account 3 investing in the plan ie. But in this blue-collar state thats closely associated with the auto industry you can wind up with a much smaller paycheck in your tank thanks to local income taxes of up to 24 in 23 Michigan cities. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Since youll be withholding income taxes in your employees home state youll need to register with the state and possibly local tax agencies. A co-signer can help you get a better rate on an auto loan. This calculator is intended for use by US.

These are contributions that you make before any taxes are withheld from your paycheck. Taxes for remote employees out of your state. A new paystub is issued each time for every specific period in time.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Income taxes paid by individuals. Income data was collected from the 2019 American Community Survey.

Annual account fees or 4 the effect of federal andor state taxes on withdrawals. How Your Michigan Paycheck Works. If you increase your contributions your.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. If youve had an on-the-books job before youre probably familiar with the basics of payroll taxes. The penalty maxes out at 25 of the taxes you owe.

If your employee works from home in another state there are three things you need to do. GOBankingRates found the total income taxes paid total tax burden total take home pay total gross bi-weekly paycheck the after income tax bi-weekly paycheck for each state and the total amount taken out of each bi-weekly paycheck due to taxes. Some creditors though like those you owe taxes federal student loans child support or alimony dont have to file a suit to get a wage garnishment.

Calculations are estimates and may not provide accurate projections. To put it one way all payroll taxes are employment taxes but not all employment taxes are considered payroll taxes. Meanwhile payroll taxes are those that are taken out from an employees paycheck and matched by their employerand more specifically Social Security and Medicare taxes.

Paycheck Calculator Take Home Pay Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Tax Withholding Calculator For W 4 Form In 2021

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis Paying Taxes Worker Workplace Accident

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest